Amazon.com, Inc.: Reinventing Tech, Retail & AI Leadership in 2025

Introduction – From Online Bookstore to Global Tech Titan

Amazon.com, Inc., founded in 1994 by Jeff Bezos, began as a simple online bookstore. Few could have imagined that within three decades, it would evolve into one of the most influential companies in the world, dominating e-commerce, cloud computing, artificial intelligence, digital streaming, and logistics innovation.

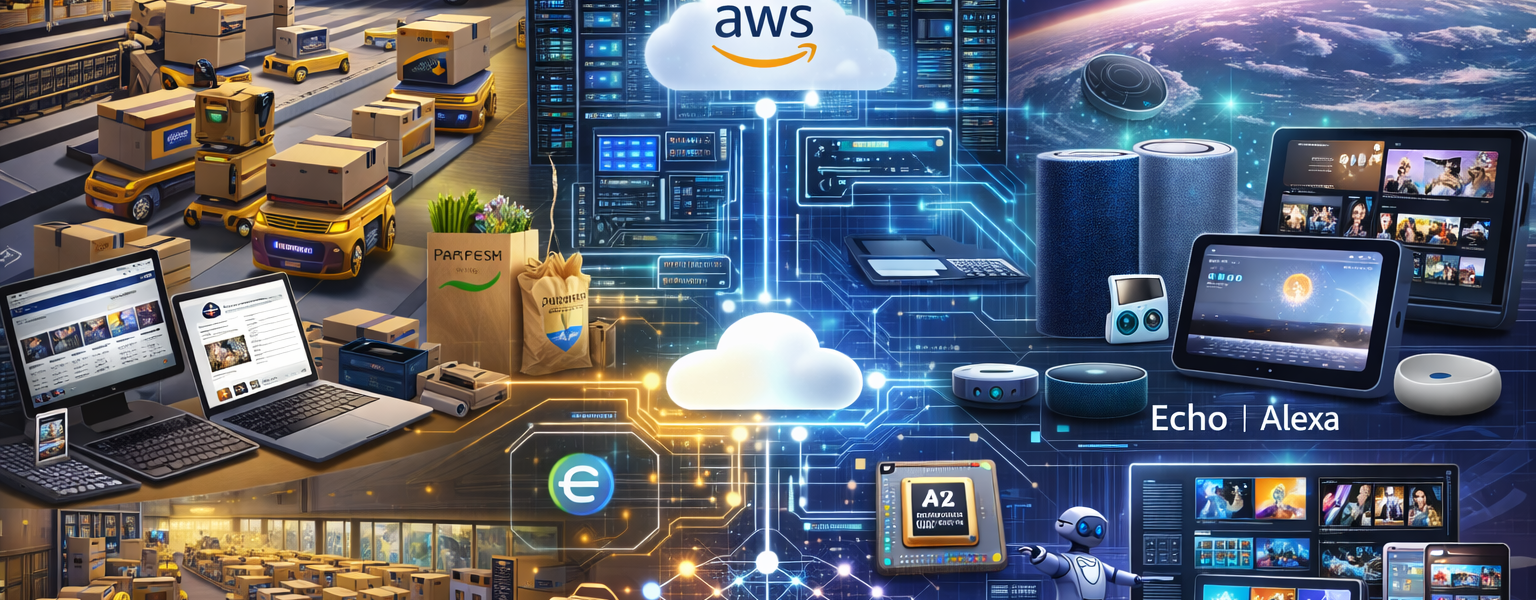

Today, Amazon is not just a retailer — it is an ecosystem that touches nearly every aspect of modern life. Whether you’re ordering groceries on Amazon Fresh, watching Prime Video, using Alexa to control your home, or relying on AWS to run business operations, Amazon has integrated itself into consumer habits and enterprise infrastructure.

The company’s transformation over the years is a masterclass in diversification — shifting from being a product seller to becoming a platform provider across multiple industries.

Q2 FY2025: A Quarter of Strong Momentum

Amazon’s second-quarter results in 2025 show that it’s growing across nearly all major divisions, even in a competitive and uncertain economy.

Headline Financials

- Net sales: $167.7 billion (↑ 13% YoY)

- Operating income: $19.2 billion (↑ 31% YoY)

- Net income: $18.2 billion (↑ 34–35% YoY)

- Earnings per share (EPS): $1.68 – significantly beating market expectations

- Free cash flow: Dropped from $53 billion to $18.2 billion (due to heavy AI and infrastructure investments)

The company is investing more heavily in cloud infrastructure, automation, and AI, signaling that it’s building long-term competitive advantages rather than focusing solely on short-term profitability.

Segment Performance Breakdown

North America – E-Commerce Core

Amazon’s North America segment generated $100.1 billion, up 11% year-over-year. Growth was fueled by Prime Day records, an increase in third-party seller activity, and faster fulfillment speeds.

International Markets

International net sales hit $36.8 billion, a 16% YoY increase (or 11% excluding currency effects). India, the UK, and Germany were strong contributors.

AWS – Amazon Web Services

AWS, Amazon’s cloud powerhouse, posted $30.9 billion in revenue, growing 17.5% YoY. The division’s operating margins remain among the highest in the industry, making AWS the profit engine of Amazon.

Advertising – A High-Growth Engine

Advertising revenue reached $15.7 billion, up 22–23% YoY. Amazon is increasingly monetizing Prime Video and Alexa voice platforms with ads, further expanding high-margin revenue streams.

Capital Investments: Betting Big on the Future

Amazon’s free cash flow drop might raise investor eyebrows, but it’s strategically intentional. The company is:

- Expanding data center capacity for AWS

- Developing Trainium2 chips for AI workloads

- Scaling robotics and warehouse automation

- Funding Project Kuiper, its satellite broadband network

These investments are long-term bets designed to maintain Amazon’s leadership in both retail logistics and enterprise technology.