Biogen (BIIB) Stock Analysis: Navigating the Alzheimer’s Gamble and the Future of Neurology

For decades, Biogen Inc. (NASDAQ: BIIB) has been a cornerstone of the biotechnology industry, a company synonymous with groundbreaking treatments for neurological diseases. Its historic dominance in the multiple sclerosis (MS) market has not only provided life-changing therapies for millions but has also generated a consistent stream of revenue and profitability. However, in recent years, Biogen has embarked on one of the most ambitious and high-stakes gambles in biopharma history: the pursuit of a cure for Alzheimer’s disease. This journey has been a rollercoaster of controversy, hope, and financial upheaval, forcing the company to navigate a new reality of intense scrutiny and immense pressure. For investors, Biogen stock represents a high-risk, high-reward proposition, a bet on whether its latest venture into Alzheimer’s will redefine its future or lead to another period of financial instability.

This comprehensive guide offers an in-depth BIIB stock analysis, providing a detailed look at the company’s core business segments, its ambitious strategic pivot, and the immense opportunities and challenges that lie ahead. We will explore the strengths of its established MS portfolio, dissect the controversy and commercial failure of its first Alzheimer’s drug, and analyze the new hope and potential of Leqembi, a key driver for future growth. By understanding these key factors, we will equip you with the insights needed to grasp the potential and inherent risks of investing in Biogen. Whether you are a long-term investor or a newcomer to the biopharma sector, this article will provide a balanced and detailed perspective on a company at a pivotal moment.

Biogen at a Glance: Key Financial Metrics

Before we dive into the details, here is a snapshot of where Biogen stands today. This provides a crucial starting point for any Biogen stock analysis.

- Ticker Symbol: BIIB

- Exchange: NASDAQ

- Market Capitalization: Approximately $40 billion (as of August 2025)

- Current Stock Price: Around $285-$288 per share (as of mid-August 2025)

- P/E Ratio: Approximately 25, reflecting a valuation that is heavily influenced by the potential of its new Alzheimer’s drug and the challenges to its core business.

- 52-Week Range: A low of approximately $220.10 and a high of $305.50, showcasing significant volatility and a market that is trying to price in the company’s future.

These figures illustrate a company that, while still an industry giant, is trading at a valuation that reflects investor concerns about its core business and the immense speculation surrounding its new pipeline. The P/E ratio, while not as high as some high-growth companies, is a clear indication of a market that is waiting to see if Biogen’s latest gamble will pay off.

The Core Business: The Multiple Sclerosis Dominance

For decades, Biogen’s financial foundation was built on its dominance in the multiple sclerosis (MS) market. The company’s portfolio of MS drugs was a consistent source of immense revenue and profitability, providing the stability and cash flow to fund its ambitious R&D efforts.

- MS Portfolio: Biogen’s MS portfolio includes some of the most well-known and widely prescribed drugs in the market, such as Tecfidera and Tysabri. These drugs have provided life-changing therapies for millions of patients and have been a primary driver of the company’s financial success.

- The Patent Cliff Challenge: The MS business, however, is facing a major challenge from patent expirations and competition from generics and biosimilars. The loss of patent exclusivity for some of its key drugs has led to a significant decline in revenue, putting pressure on the company’s financial performance. This is a major headwind that Biogen is still navigating.

- The Next Generation: To combat the decline in its MS business, Biogen is focused on a new generation of MS drugs, such as Vumerity, and it is investing in new R&D to maintain its leadership in the market. The success of these new products is crucial for the company to maintain a stable foundation as it pursues new growth opportunities.

The Alzheimer’s Gamble: From Controversy to Hope

The most important part of the Biogen stock analysis is understanding its high-stakes bet on Alzheimer’s disease, a journey that has been a rollercoaster of controversy and hope.

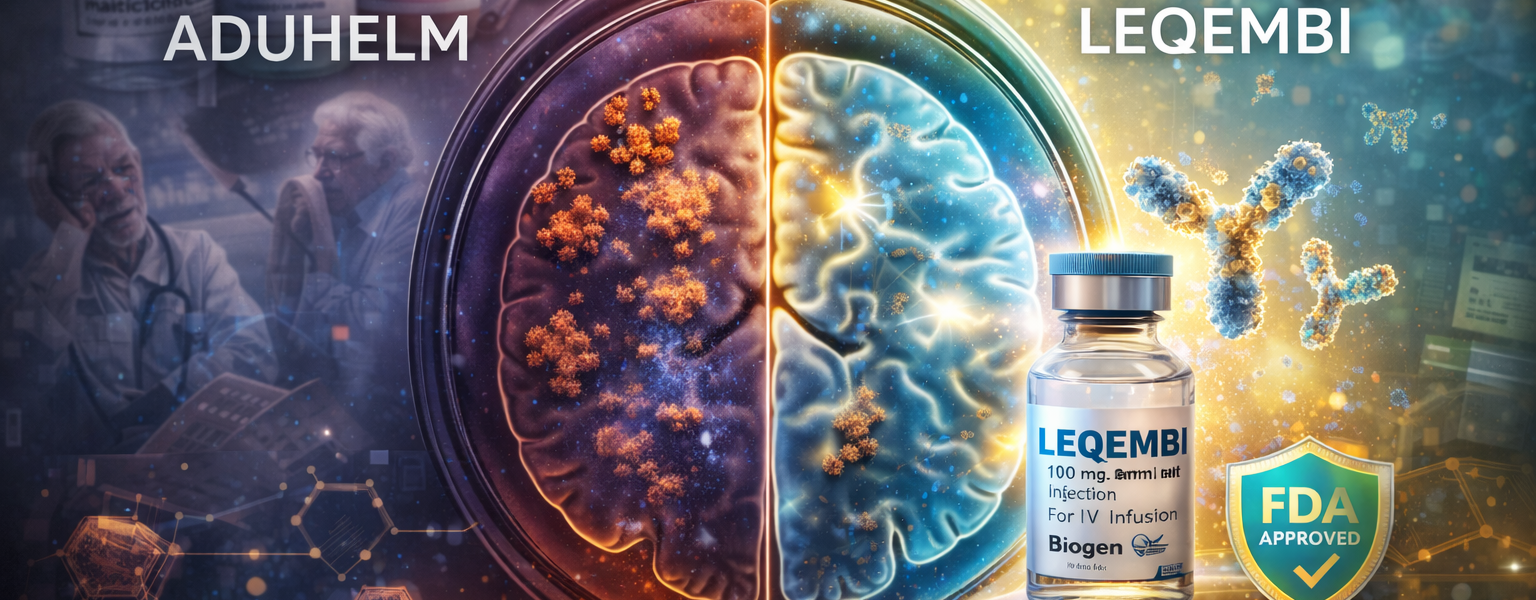

- Aduhelm: The Controversy and Failure: In 2021, Biogen received accelerated FDA approval for Aduhelm, a drug designed to treat early-stage Alzheimer’s disease. The approval was highly controversial, as an FDA advisory panel had voted against the drug’s effectiveness. The commercial rollout of Aduhelm was a major failure, with the drug failing to gain a foothold in the market due to a lack of clear clinical benefit, safety concerns, and a highly restrictive reimbursement policy from the Centers for Medicare & Medicaid Services (CMS).

- Leqembi: The New Hope: In the wake of the Aduhelm failure, Biogen, in partnership with Eisai, has pinned its hopes on a new Alzheimer’s drug called Leqembi. Unlike Aduhelm, Leqembi received a full FDA approval, which was based on compelling clinical data that showed a clear, albeit modest, benefit in slowing cognitive decline in early-stage Alzheimer’s patients. This full approval has made Leqembi a key driver for future growth and a major point of interest for investors.

- The Commercial Opportunity: The commercial opportunity for Leqembi is immense. Alzheimer’s disease affects millions of people worldwide, and there is a massive unmet need for effective treatments. If Leqembi can be successfully commercialized, it has the potential to become a multi-billion-dollar blockbuster and to fundamentally change the financial trajectory of Biogen.

The Pipeline and Growth Strategy

While the Alzheimer’s gamble is a key part of Biogen’s story, the company also has a robust R&D pipeline and a number of key products in other therapeutic areas.

- Spinal Muscular Atrophy (SMA): Biogen, in partnership with Ionis Pharmaceuticals, developed Spinraza, a groundbreaking drug for spinal muscular atrophy (SMA), a rare and devastating genetic disease. Spinraza has been a major success, providing a significant source of revenue for the company and a powerful example of its commitment to rare disease research.

- Neurodegenerative Diseases: Beyond MS and Alzheimer’s, Biogen has a robust pipeline of drugs in development for a number of other neurological disorders, including Parkinson’s disease and amyotrophic lateral sclerosis (ALS). The company’s deep expertise in neurology gives it a natural advantage in these highly complex therapeutic areas.

- M&A and Strategic Partnerships: To accelerate its R&D efforts and to acquire new, high-growth products, Biogen is focused on strategic acquisitions and partnerships. This is a key part of its growth strategy and a way for it to diversify its pipeline and to acquire new technologies.

Financial Performance and the Path to Profitability

A look at Biogen’s recent financials reveals a company that has been navigating a period of significant change. The financial failure of Aduhelm had a major impact on the company’s profitability, but the potential success of Leqembi has created a new sense of optimism.

- Aduhelm’s Financial Impact: The commercial failure of Aduhelm was a major financial blow to Biogen. The company took a number of charges and writedowns, and the drug failed to generate a significant amount of revenue, putting pressure on the company’s operating margins and profitability.

- The Leqembi Opportunity: The potential success of Leqembi could dramatically change the financial picture for Biogen. The drug has a massive commercial opportunity, and if it can be successfully commercialized, it has the potential to generate billions of dollars in revenue and to restore the company’s profitability.

- The Investment Thesis: The BIIB stock forecast is now largely dependent on the company’s ability to successfully commercialize Leqembi. If it can grow its Alzheimer’s business while maintaining the stability of its core MS and SMA franchises, the stock could see a significant re-rating from the market.

The Investment Thesis: Why BIIB Stock is a High-Risk, High-Reward Bet

In summary, the investment thesis for Biogen is a compelling story of a company at a major crossroads. The company’s stable core business in MS is facing a number of challenges, and its future is tied to the success of its high-stakes bet on Alzheimer’s disease.

- Leqembi’s Potential: The potential of Leqembi to become a blockbuster drug is the primary reason to be optimistic about Biogen. The drug has received full FDA approval, and it has the potential to generate billions of dollars in revenue and to fundamentally change the company’s financial trajectory.

- The Core Business: While facing challenges, Biogen’s core MS and SMA franchises provide a stable foundation that generates a consistent stream of revenue. This stability provides the company with the financial flexibility to invest in its R&D pipeline and to pursue new growth opportunities.

- The Pipeline: The company’s robust R&D pipeline, with a focus on a number of other neurological disorders, provides a number of other potential growth drivers that could lead to a new generation of blockbuster drugs.

- The High Risk: The failure of Aduhelm is a clear reminder of the high risks involved in drug development and commercialization. Leqembi, while a promising drug, is not without its own challenges, including reimbursement hurdles and competition from other companies in the Alzheimer’s space.

Potential Risks and Challenges

While the outlook for Biogen is largely positive, a balanced analysis must consider potential risks and challenges.

- Reimbursement Hurdles: The commercial success of Leqembi is highly dependent on reimbursement from insurers and government programs. The experience with Aduhelm showed that even with FDA approval, a drug can fail if it cannot gain broad reimbursement.

- Competition: The Alzheimer’s market is highly competitive, with a number of large pharmaceutical companies and new biotechs vying for market share. A new drug from a rival company that shows a greater benefit or has fewer side effects could pose a major threat to Leqembi.

- Pipeline Failures: The R&D process is long, expensive, and risky. A drug that looks promising in the early stages of development can fail in the later stages, which would have a significant impact on the company’s future growth.

Conclusion: Can Biogen Reclaim its Throne?

In conclusion, Biogen Inc. is a company at a pivotal moment in its history. It is a story of a neurology pioneer that is successfully navigating the challenges of its industry and is placing a high-stakes bet on a new frontier. The company’s strategic focus on Leqembi and its robust R&D pipeline are a bold and necessary move that will define its future.

The company’s strong foundation, its focus on innovation, and the immense potential of Leqembi make it a compelling choice for investors seeking a high-risk, high-reward investment in the biopharma sector. The final decision to buy Biogen stock rests on one’s belief in the company’s ability to execute on its ambitious vision and to successfully navigate the complex and evolving landscape of the biotech industry.

Disclaimer: This content is for informational purposes only and should not be considered financial advice. All investment decisions should be based on your own research and consultation with a financial advisor.